The Federal Reserve Board has once again raised interest rates attempting to curb the rate of price inflation. What this monetary policy fails to address is the rate in which the corporations are raising prices, exploiting their leverage, and passing cost increases to the consumers while reaping record profits. This is the case in many of the market sectors.

The Federal Reserve Board has once again raised interest rates attempting to curb the rate of price inflation. What this monetary policy fails to address is the rate in which the corporations are raising prices, exploiting their leverage, and passing cost increases to the consumers while reaping record profits. This is the case in many of the market sectors.

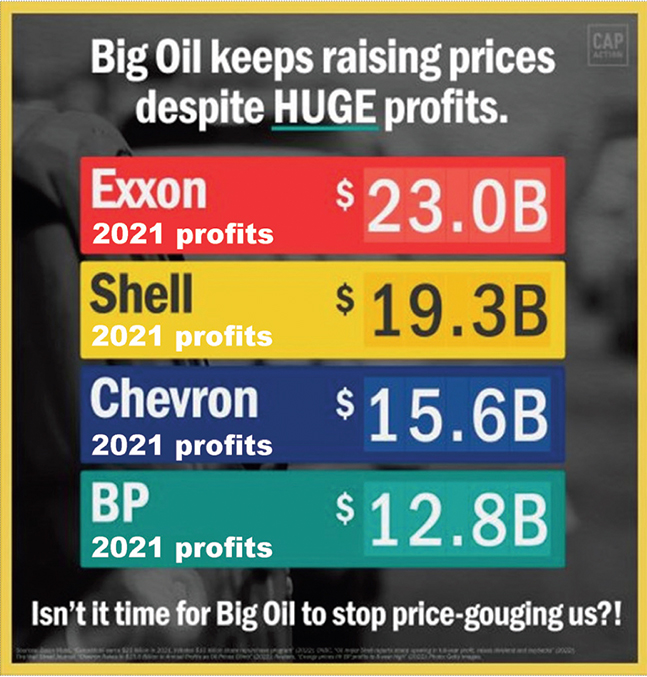

Two of the most common and basic needs for consumers are gas and food. Both of these sectors are recording record profits while increasing prices at a rate we have not witnessed in decades. As of today, gas prices are near all-time highs, averaging $4.59 per gallon. While Americans are paying more at the pump, oil companies are paying less to produce that gas. They are keeping gas prices artificially high to maximize their profits at the expense of the end use consumers. These are wartime profits created in part by sanctions, which add to supply chain issues during a time of high demand. Many of these profits are being used to enrich investors in the form of stock buybacks, aimed at driving up stock prices which are broadly owned by company CEO’s and executives.

Everyone who has made a trip to the grocery store recently has felt the pain at the cash register. Although higher fuel prices have an impact on the overall cost of goods and services, the rate of inflated prices at the register is disproportionate to the increased costs incurred by the major food producing corporations and their recent profits illustrate exactly that.

Tyson, one of the “Big 4” meat and poultry conglomerates whose price increases have been scrutinized by the Biden Administration, posted over $1 billion in profit in Q1’22, an increase of a staggering 48% from the previous year, as beef prices surged over 23%, Pork 14%, and Poultry 12.5%. Tyson is one of four meat companies that own 85% of the beef market. Currently a mere 4 companies control 90% of the baby formula market, 3 companies control 78% of the pasta market and only 3 companies control 72% of the cereal market.

Price gouging by the largest corporations have placed a tremendous burden on working families. This generating windfall profits for the corporate giants, making 2021 the most profitable year for big corporations since the 1950’s, with pretax profits surging to 2.5 trillion and post-tax profits rising a whopping 35%.

There are legitimate cost increases that the corporations are struggling with, such as supply chain shortages, shipping, and increased cost of fertilizers, many due in part by the Ukraine invasion and sanctions against Russia. Consumers understand that, but when profits soar at a rate far above the inflated costs incurred by the corporations it leads most to realize that there is greed in the mix, and the greed continues to make the rich get richer off the backs of you and me.

GAS PER GALLON PRICES VS. OIL PER BARREL COSTS

March 2008

Gas: $3.23 per gallon

Oil: $104.54per barrel

March 2014

Gas: $3.51 per gallon

Oil: $102.28 per barrel

March 9, 2022

Gas: $4.10 per gallon

Oil: $111.42 per barrel

May 24th, 2022

Gas: $4.59 per gallon

Oil: $109.70 per barrel